If you run a business of any size, you know how important it is to keep track of your spending.

Not only to make sure you aren’t overspending, but to make sure you can report your expenses accurately to HMRC when it’s time to file your accounts or self-assessment.

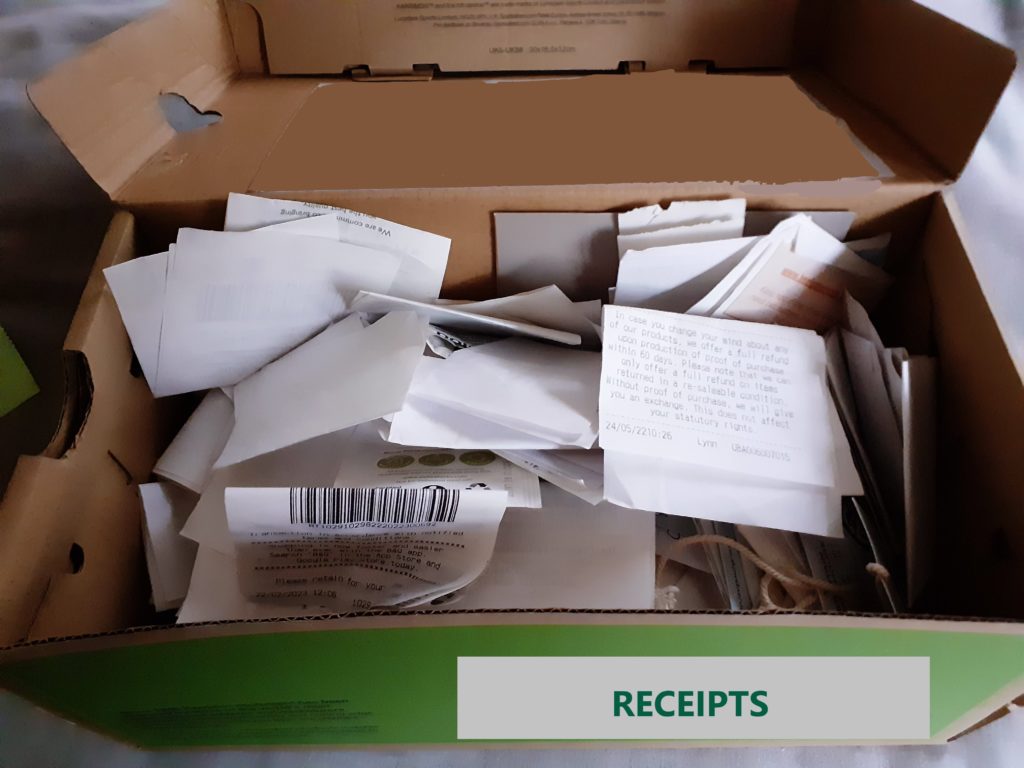

As much as we tell ourselves that we’ll get to it eventually, by the time it comes to filling in our tax returns, there are still hundreds of receipts filling every nook and cranny of our homes. The most popular place to store invoices and receipts, other than the beloved pocket, of course, is the shoebox.

Some shoeboxes are not your usual shoebox. Some are office file boxes, plastic wallets, and even spare drawers. Wherever you’ve stored them, if they’re together and not in any sort of order, then you know exactly what we’re talking about. It’s bad bookkeeping, through and through, but it can be easily remedied. The last thing you want to do is hand a shoebox or its equivalent to your bookkeeper or accountant.

Incomplete records are a nightmare for the person doing your tax return, whether it’s you – the business owner – or someone completing them on your behalf.

Dealing With The Shoebox

If it does happen, and you are handed a shoebox, you will need to be systematic about sorting it before you can get any other work done. Start by picking up the very first receipt that your hand comes in contact with, note the date, write the month and year on a stick note, and create a pile for that month. Do this for every month of the tax year, put them all in order, and watch the piles grow.

Next, you could put each individual receipt in date order within its month. It just depends on what you would find easier while trying to match the records to your client’s or your personal bank statements. There’s no one way to sort out a shoebox of receipts, but it is going to take a lot more time than you realise. It’s best avoided, if at all possible.

Implementing Better Bookkeeping Habits

There are several ways to make bookkeeping easier, even for the newest business owners. It’s time to get professional, which means new software and possibly hiring a qualified bookkeeper.

First of all, ensure that you have a proper filing system in place for all of your receipts and invoices. You should keep such things in dated folders, and those folders should be in a box that you only use for your business paperwork. Don’t mix up your financial paperwork with your client information or your business propaganda.

If you do have an accountant, ask them how you can work together as a team to make their job easier when it comes to tax return time. Your accountant or bookkeeper works overtime to ensure that your accounts are all in order, so helping them out will help you in the long run.

Finally, remember to update your books. You can use bookkeeping to grow your business if you document everything properly. Stop holding yourself back, and watch how your business can bloom by just having the numbers of what is and isn’t working close by.

At GB Bookkeeping we meet a lot of business owners who run their business out of a shoebox, an exercise book or a spreadsheet. But it doesn’t have to be that way. We can help you sort through the shoebox, put it all into an online bookkeeping system and implement a new process for you, making it easier than ever to keep clear, consistent records. We can even manage your books for you going forward, so you don’t need to worry about that aspect of your business at all – just relax and focus on doing what you do best. To find out more, just get in touch with the team today.